Delving into the world of dividend ETFs, this comprehensive guide sheds light on the rising popularity of investments like JEPI. Offering a blend of informative insights and captivating analysis, readers are in for an enlightening journey through the realm of dividend ETFs.

Providing a detailed overview and analysis of various aspects related to dividend ETFs, this guide aims to equip investors with the knowledge needed to navigate this evolving landscape with confidence.

Introduction to Dividend ETFs

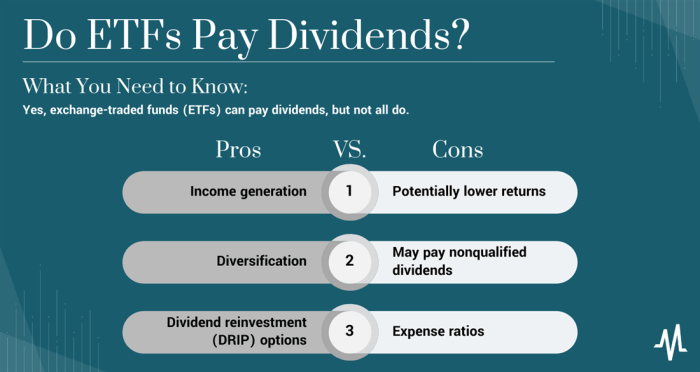

Dividend ETFs, or exchange-traded funds, are investment funds that focus on holding a basket of dividend-paying stocks. These funds provide investors with a way to gain exposure to a diversified portfolio of dividend stocks without having to buy individual company shares.

Concept of Dividend Investing

Dividend investing involves selecting stocks that pay out a portion of their earnings to shareholders in the form of dividends. This strategy aims to generate a steady stream of income for investors, which can be particularly attractive for those looking for passive income or seeking to supplement their overall investment returns.

Benefits of Dividend ETFs for Investors

- Diversification: Dividend ETFs offer investors exposure to a broad range of dividend-paying stocks, reducing the risk associated with holding individual securities.

- Income Generation: By investing in dividend ETFs, investors can potentially earn regular income through the dividends paid out by the underlying stocks.

- Long-Term Growth: Many dividend-paying companies are stable and established, making dividend ETFs a viable option for long-term growth and wealth accumulation.

- Lower Costs: Compared to actively managed funds, dividend ETFs typically have lower expense ratios, leading to cost savings for investors.

Understanding JEPI ETF

JEPI ETF, or JPMorgan Equity Premium Income ETF, is an exchange-traded fund that aims to provide investors with a high level of current income by investing in a diversified portfolio of dividend-paying equity securities.

Overview of JEPI ETF Holdings

JEPI ETF holds a mix of U.S. and international equity securities, including common stocks and real estate investment trusts (REITs). The fund focuses on companies that have a history of paying dividends, with an emphasis on those that have the potential for dividend growth.

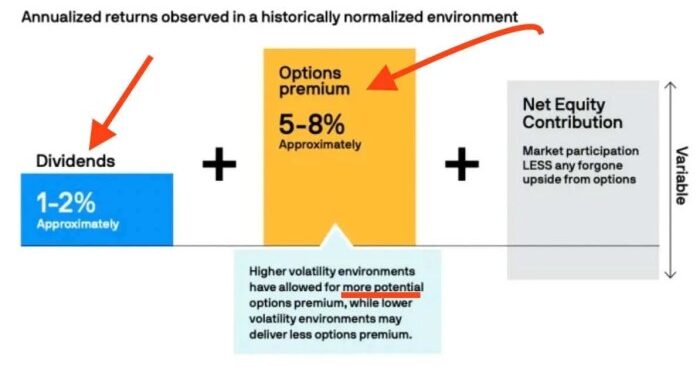

Investment Strategy of JEPI ETF

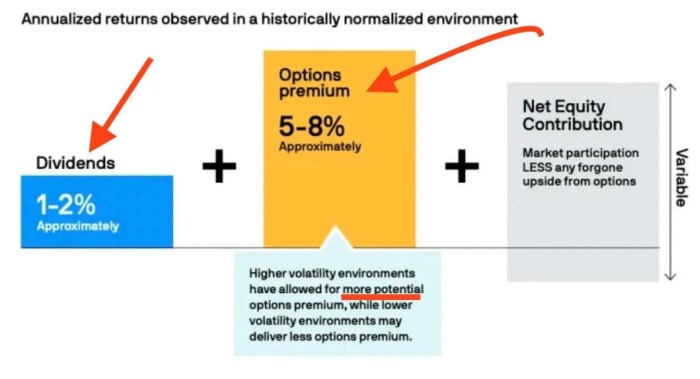

The investment strategy of JEPI ETF involves actively managing the portfolio to maximize income while maintaining a level of risk that is appropriate for income-oriented investors. The fund may use options strategies to enhance income and manage risk, as well as to potentially generate additional returns.

- JEPI ETF focuses on companies with strong fundamentals and attractive dividend yields.

- The fund may tilt towards sectors that have historically provided higher dividend yields, such as utilities, consumer staples, and healthcare.

- JEPI ETF seeks to provide investors with a steady stream of income through dividends, which can be particularly appealing in a low-interest-rate environment.

The Rise of Dividend ETFs

Dividend ETFs have been gaining popularity among investors for several reasons. These ETFs provide a steady stream of income through dividends paid by the underlying stocks in the portfolio. In a low-interest-rate environment, investors are turning to dividend ETFs to generate income while potentially benefiting from capital appreciation.

Performance Comparison

When comparing the performance of dividend ETFs like JEPI with other types of ETFs, it is important to consider the investment objectives. Dividend ETFs typically focus on companies with a history of paying consistent dividends, which can provide stability in volatile markets.

On the other hand, growth ETFs may prioritize companies with higher growth potential but may not offer the same level of income.

- Dividend ETFs like JEPI often outperform in bear markets due to the defensive nature of dividend-paying stocks.

- In bull markets, growth ETFs may outperform dividend ETFs as investors chase higher returns.

- Overall, dividend ETFs can provide a balance of income and growth potential, making them suitable for investors seeking a more conservative approach.

Role in Diversified Portfolio

Including dividend ETFs in a diversified investment portfolio can offer several benefits. These ETFs can provide a source of passive income, which can be reinvested or used for living expenses. Additionally, dividend-paying stocks have historically shown lower volatility compared to non-dividend-paying stocks, adding stability to a portfolio.

- Dividend ETFs can act as a hedge against market downturns, as the income from dividends can offset potential losses in stock prices.

- By including dividend ETFs alongside growth or value ETFs, investors can achieve a balanced portfolio that caters to both income generation and capital appreciation.

Factors Driving the Growth

The rise of dividend ETFs can be attributed to several key factors that have influenced investor behavior in recent years. One of the main drivers behind the popularity of dividend ETFs is the low-interest rate environment that has persisted for an extended period.

With interest rates at historically low levels, investors have been seeking alternative sources of income to generate returns on their investments.

Role of Low-Interest Rates

The role of low-interest rates cannot be understated when analyzing the growth of dividend ETFs. In a low-yield environment, traditional fixed-income investments such as bonds offer minimal returns, prompting investors to turn to dividend-paying stocks for higher income potential. Dividend ETFs, which pool together a diversified portfolio of dividend-paying stocks, have become an attractive option for investors looking to generate consistent income in a low-rate environment.

Impact of Market Volatility

Market volatility has also played a significant role in driving investors towards dividend-focused investments like ETFs. During periods of uncertainty and market turbulence, dividend-paying stocks have historically demonstrated resilience and stability compared to non-dividend-paying stocks. The predictability of dividend income and the defensive nature of these investments make dividend ETFs an appealing choice for investors seeking to mitigate risk and preserve capital in volatile market conditions.

Risks and Challenges

Investing in dividend ETFs like JEPI can offer attractive income potential, but it's essential to be aware of the risks involved and the challenges investors may face when selecting these types of investments.

Market Volatility

Market volatility can impact dividend ETFs, causing fluctuations in the fund's value and dividend payouts. During periods of market turbulence, dividend stocks may underperform, leading to lower income for investors. It's crucial for investors to assess their risk tolerance and be prepared for potential fluctuations in dividend yields.

Interest Rate Risk

Dividend ETFs are sensitive to changes in interest rates. When interest rates rise, dividend yields may become less attractive compared to fixed-income investments. Investors need to consider the impact of interest rate movements on their dividend ETF holdings and adjust their investment strategy accordingly.

Sector Concentration Risk

Some dividend ETFs may have a high concentration of holdings in specific sectors, such as utilities or financial services. This sector concentration can expose investors to risks related to the performance of those industries. Diversification is key to managing sector concentration risk in dividend ETFs like JEPI.

Dividend Cuts and Suspensions

Companies within a dividend ETF may reduce or suspend their dividend payments, especially during economic downturns or financial difficulties. This can significantly impact the overall dividend income generated by the ETF. Investors should research the dividend history of the underlying companies to assess the risk of potential dividend cuts.

Liquidity Risk

Liquidity risk arises when there is a limited market for the ETF's shares, making it challenging to buy or sell them at fair prices. Illiquid ETFs like JEPI may experience wider bid-ask spreads and price discrepancies, leading to potential losses for investors.

Understanding the liquidity profile of the ETF is crucial for managing this risk effectively.

Future Outlook for Dividend ETFs

As dividend ETFs like JEPI continue to gain popularity, it is essential to consider the future trajectory of these investment vehicles. This section will explore potential growth trends, innovations, and regulatory impacts on the dividend ETF landscape.

Predicted Growth Trajectory

Dividend ETFs are expected to experience steady growth in the coming years, fueled by investors' increasing interest in passive income generation and dividend-paying stocks. With the current low-interest-rate environment, dividend ETFs offer an attractive alternative for investors seeking yield.

Potential Innovations in Dividend ETF Offerings

- Smart Beta Dividend ETFs: These ETFs utilize factor-based strategies to enhance dividend yield and overall performance.

- Sector-Specific Dividend ETFs: ETFs focusing on specific sectors or industries may gain popularity, allowing investors to target dividend-paying companies within their preferred sectors.

- Global Dividend ETFs: ETFs offering exposure to international dividend-paying stocks may see increased demand as investors seek diversification and higher yields.

Regulatory Changes Impacting Dividend ETFs

- SEC Regulations: Any changes in SEC regulations related to ETFs, such as reporting requirements or tax treatment, could impact the dividend ETF landscape.

- Corporate Tax Policies: Changes in corporate tax rates or policies may influence the dividend-paying behavior of companies held within dividend ETFs, affecting overall returns.

- Environmental, Social, and Governance (ESG) Criteria: Increasing focus on ESG factors may lead to the development of ESG-focused dividend ETFs, catering to socially responsible investors.

Outcome Summary

In conclusion, the discussion on The Rise of Dividend ETFs Like JEPI Explained encapsulates the essence of this investment trend, highlighting key factors, risks, and future prospects. With this guide, investors are poised to make informed decisions in the realm of dividend ETFs.

Answers to Common Questions

What are dividend ETFs?

Dividend ETFs are exchange-traded funds that focus on investing in stocks of companies with a history of paying out dividends to shareholders.

How does JEPI ETF differ from other dividend ETFs?

JEPI ETF stands out for its unique holdings and investment strategy, which sets it apart from traditional dividend ETFs.

What are the risks associated with investing in dividend ETFs?

Potential risks include fluctuations in dividend payouts, market volatility affecting stock prices, and interest rate changes impacting dividend yields.

How can investors manage risks when investing in dividend ETFs?

Investors can diversify their portfolio, conduct thorough research on ETFs, and consider the overall market conditions to manage risks effectively.