Starting off with Debt Management vs. Investment: What Comes First?, this introductory paragraph aims to grab the attention of readers and provide a brief overview of the topic in a captivating manner.

The following paragraph will delve into the specifics and details of the topic at hand.

Understanding Debt Management

Debt management refers to the process of effectively handling and controlling one's debt obligations. It involves creating a plan to pay off debts systematically while also ensuring that new debts are taken on responsibly.

Importance of Managing Debt Effectively

Effective debt management is crucial for maintaining financial stability and achieving long-term financial goals. It helps individuals avoid excessive debt burdens, high-interest payments, and potential credit issues.

- By managing debt effectively, individuals can improve their credit score and financial health.

- It allows for better budgeting and planning for future expenses.

- Proper debt management can lead to reduced stress and improved overall well-being.

Common Strategies for Debt Management

There are several strategies that individuals can use to manage their debts efficiently:

- Creating a budget: Establishing a budget can help individuals track their expenses and allocate funds towards debt repayment.

- Debt consolidation: Combining multiple debts into a single payment with a lower interest rate can make repayment more manageable.

- Setting financial goals: Having clear financial goals can motivate individuals to prioritize debt repayment and make necessary lifestyle changes.

- Seeking professional help: Consulting with a financial advisor or credit counselor can provide valuable guidance on debt management strategies.

Impact of Debt on Personal Finances

Debt can have a significant impact on personal finances, affecting factors such as savings, credit score, and overall financial well-being.

High levels of debt can lead to financial stress, limited borrowing capacity, and hindered ability to save for the future.

- Interest payments on debts can consume a significant portion of income, reducing funds available for savings or investments.

- Excessive debt can affect creditworthiness, making it challenging to access favorable loan terms or secure future financial opportunities.

- Failure to manage debt effectively can lead to a cycle of debt accumulation, making it harder to achieve financial stability in the long run.

Exploring Investment

Investment refers to allocating money with the expectation of generating a return or profit in the future. It plays a crucial role in financial planning and wealth-building by allowing individuals to grow their assets over time.

Types of Investments

- Stocks: Stocks represent ownership in a company and can offer significant returns, but they also come with higher volatility and risk.

- Bonds: Bonds are debt securities issued by governments or corporations, providing a fixed income stream but typically lower returns compared to stocks.

- Real Estate: Investing in real estate involves buying properties to generate rental income or capital appreciation.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets.

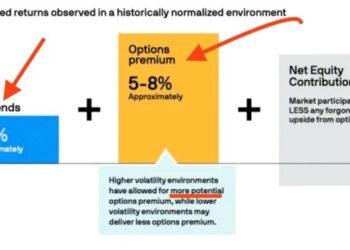

Risks and Rewards of Investment

- Risk:All investments carry some level of risk, with higher potential returns often associated with higher risk. It's essential to assess and manage risk effectively to protect your investment capital.

- Rewards:Successful investments can lead to capital appreciation, passive income, and overall wealth accumulation over time. Properly managed investments can help individuals achieve their financial goals.

Role of Investments in Building Wealth

Investments play a vital role in building wealth by allowing individuals to grow their money over time through compound interest and capital appreciation. By strategically allocating funds into various investment vehicles, individuals can increase their net worth and achieve financial independence in the long run.

Prioritizing Debt Repayment vs. Investment

When it comes to managing finances, the decision between prioritizing debt repayment or investing can be a tough one. Both options have their benefits and it's essential to understand the implications of each choice.

Reasons for Prioritizing Debt Repayment

One common reason for suggesting focusing on debt repayment before investing is the high interest rates associated with debt

- Lowering overall debt burden

- Improving credit score

- Reducing financial stress

Scenarios Benefiting from Debt Repayment First

In scenarios where the debt carries high interest rates, such as credit card debt, prioritizing repayment can lead to significant savings. Additionally, individuals with multiple debts may benefit from focusing on debt repayment to streamline their financial obligations.

Advantages of Investing with Debt Management

While debt repayment is crucial, investing can also play a vital role in building long-term wealth. By investing while managing debt, individuals can take advantage of compounding returns and start building a diversified portfolio for the future.

- Building wealth over time

- Diversifying investment portfolio

- Taking advantage of market opportunities

Long-Term Effects of Prioritizing Debt Repayment vs. Investing

Choosing between debt repayment and investing can have long-term implications on one's financial health. Prioritizing debt repayment can lead to financial stability and reduced stress, while investing early can lead to greater wealth accumulation over time. It's essential to strike a balance between the two based on individual financial goals and circumstances.

Strategies for Balancing Debt Management and Investment

When it comes to balancing debt management and investment, it's crucial to have a clear plan in place. This involves strategically allocating your resources to both paying off debts and investing for the future. By following a step-by-step guide and implementing smart strategies, you can effectively manage your debts while still growing your wealth through investments.

Maximizing Returns While Paying Off Debt

- Focus on high-interest debt: Start by tackling debts with the highest interest rates first, such as credit card debt. By reducing these high-interest debts, you can save money in the long run.

- Automate payments: Set up automatic payments for your debts to ensure you never miss a payment. This can help you avoid late fees and improve your credit score.

- Consider debt consolidation: Consolidating multiple debts into a single loan with a lower interest rate can make it easier to manage your debt and potentially save money on interest payments.

Creating a Financial Plan for Debt Management and Investment

- Evaluate your financial goals: Determine your short-term and long-term financial goals to create a roadmap for balancing debt repayment and investment.

- Set a budget: Establish a budget that includes allocations for debt repayment, savings, and investments. Stick to this budget to stay on track with your financial plan.

- Seek professional advice: Consider consulting a financial advisor to help you create a comprehensive financial plan that aligns with your goals and risk tolerance.

Successful Strategies for Achieving Balance

- Diversify investments: Spread your investments across different asset classes to reduce risk and maximize returns over time.

- Reinvest returns: Instead of cashing out profits from investments, consider reinvesting them to accelerate your wealth growth.

- Regularly review your financial plan: Monitor your progress towards debt repayment and investment goals regularly, and adjust your plan as needed to stay on course.

Conclusive Thoughts

Concluding our discussion on Debt Management vs. Investment: What Comes First?, this final paragraph will summarize the key points and leave readers with some food for thought.

FAQ Overview

Why is it important to manage debt effectively?

Managing debt effectively is crucial as it can impact your financial health and future stability. By managing debt well, you can avoid high-interest payments and improve your credit score.

Is it better to focus on debt repayment before investing?

For many individuals, prioritizing debt repayment before investing is recommended as it can lead to financial stability and lower overall debt burden.

How can one balance debt management with investment?

Balancing debt management with investment involves creating a financial plan that allocates funds for both debt repayment and investing, prioritizing based on individual circumstances and goals.